Blockchain: Hype or hope? We are at a crossroads. Quo vadis? A year-end view of what and why

Is the DLT potential real, why haven’t we realised it, will we ever realise any of it? These are all questions worth examining. Here’s my view as we end 2019 and plan for progress in 2020. It’s a long piece; your feedback is really welcome.

Blockchain is for sure not the only way to advance technology and equally for sure there are other ways to solve the challenges that people are suggesting it be used for. See the Gartner Hype Cycle for a view on how these things generally play out.

Put the hype and discussion aside; the advent of Blockchain has done one very good thing for Financial Services, which is to make us evaluate what might be possible. On that basis, I’d like to look at whether there is potential and how do we achieve it.

Waste matters

Financial services are a huge contributor to GDP; the sector accounts for as much as 7.5% of GDP, how efficient it is makes a difference to the ordinary man in the street. Generally, banks are struggling to make profits and cutting costs to try to chase profitability, most of that in people, but as the FT pointed out in a December 2019 article: one cannot cut to glory.

Business process is something that makes the difference between profit and loss; in times past, banks made what the economists call ‘super-normal profits’; revenues greatly exceeded costs and life was good, even very good. Today’s environment looks more like one of ‘normal profit’; everybody makes a dollar. Who wins is a function of who keeps the biggest share of that dollar. He with the best process will win.

Where to look for improvements & savings

My way of looking at what might or might not achieve, in terms of process improvement and impact on the cost/income ratio, is to look at ‘internal efficiencies’ vs. ‘external efficiencies’. Internal is all about what one institution or group can achieve on its own, without explicit cooperation from outside parties. External is about all the processes that involve other parties, either pre- or post-trade.

Many of these things will be as true in financial services, as they are in other industry sectors.

Internal Efficiency

For any one institution there is a cap on internal efficiency; any one business can only be as effective as the external circumstances allow. If the existing way of working says you have to physically sign and return a document by post, then that process is a given.

It would be something of an understatement to say that, in financial services, institutions have nowhere near maxed out their potential to reap internal efficiencies. I see various factors which contribute to this malaise; firstly, the realpolitik of having to do all the regulatory change which leaves little room for any discretionary spend. Another is the cost of change vs. the marginal benefit. Three life lessons from wholesale banking:

- It is a fact of life that any change idea that does not move the cost meter by more than $500k per year is pretty much a non-starter. For a more detailed look at how hard it is to pitch and sell a new FinTech product.

- Sometimes not adopting those 500k saves will come back to haunt you. Back in 2012 a client rejected an idea of mine around inter-company payments and external banking spend. One-time $500k spend to gain $500k in reduced external spending. A good but not great return. Just 4 years later; when the same bank realised they had to allocate liquidity costs properly, the same idea was worth $7.5 million a year. A bit of a «Beatles and guitars» moment.

- Banks have been looking for a way out of the pain of their legacy IT estate. I like the RBS play; their new retail platform Bo is a green field entity, with no legacy tech. They will migrate the clients and turn off the legacy systems. Eventually.

There are still good reasons to invest in ensuring you have both control & capacity with robust procedures for all things operational. One of these is OpRisk aka Operational Risk. There are two sides to OpRisk work: developing robust processes & systems and having the right people in place to help ensure things don’t go wrong, and the post-incident work that captures the detail and the consequences when things do go wrong.

In banks operational errors have two costs, one of them immediate, visible and easily measured, the other slightly hidden and often more permanent. In fact, sometimes, even a near miss can lead to more permanent costs. First, the obvious costs. If you have a ‘fat finger’ problem, for example, executing the wrong quantity in the market, then unwinding the error will cost money. A couple of good examples illustrate the costs:

- In 2012, a trader at a small US brokerage input an order to buy 1,625,000 shares of Apple rather than 1,625. There was some fraud involved too. Unwinding the trade cost the firm its existence. Some basic controls would have saved the firm; the order was by any measure way bigger than any other order the firm would handle. An extra sign-off from an approver for something that is not normal would have been merited. See: Rochdale Securities Trader Arrested And Charged With Wire Fraud.

- In 2011, another rogue-trader incident, this time involving a trader called Kweku Adoboli at UBS, led to losses of $2.3 billion for the bank. If you crash your car a lot, then your insurance premium goes up, the pendant to that in banking is the amount of capital required to cover OpRisk. The capital requirement to support OpRisk is twice that for Market & Interest Rate Risk. See: Risk Management Magazine, Australia, The Future of Operational Risk. In 2013, the Swiss regulator asked UBS to increase the capital it holds for OpRisk by 50%. This added CHF 28 billion in risk weighted assets. This is hidden cost; the cost of the semi-permanent increase in capital.

- In fact, even a near miss can have OpRisk capital implications. In April 2018, Deutsche Bank actually made a $35 billion payment in Euro, in error. More than two-times the value of the bank. You would have to think that that error had a knock-on effect on OpRisk capital and with that a near permanent cost. Another case for controlling exceptions. More capital equates to yet more cost.

Managing capacity is another evergreen topic. Banks and probably most large institutions have lots of everyday tasks where a staff member performs heroics, often with little system support, or perhaps an Excel spreadsheet to get things done. Everything works as long as our hero is not out of the office. One of my really good friends was recently put into one of these ‘accident waiting to happen’ spots; special process, all manual, supported by just one person, a hero with his own bit of end user computing temporary solution, who would often work nights and weekends. The hero had decided to move on internally and that was approved without a proper transition. My friend discovered aged problems going back months; the systems and procedures that were just not fit for purpose.

Banks specifically, and I would take an educated guess large institutions in general, have something I would call an “efficiency curse”; technology means we need fewer people, so teams are getting smaller and with that they are less flexible and will tend to concentrate knowledge with their heroes. Suddenly you have teams of three, where you can count the weeks all three are in the office together on the fingers of one hand. There is improvement to me made on pooling resources, cross-training, defining precise procedures.

So far, no mention of the B(lockchain) word. I can think of just two cases where a bank has used Blockchain to gain internal efficiencies, or at least try to. In early 2019, HSBC announced their HSBC FX Everywhere solution, a Blockchain based internal FX booking solution See HSBC settles $250bn of FX transactions using distributed ledger technology. A couple of observations on this one. First, I was told by an insider that the booking of the settlement monies was still to legacy platforms and second, and as somebody who has an advanced degree in matters Inter-company from the University of Life’s School of Hard Knocks, I would say announcing in 2019 you are using Blockchain to solve inter-company trade booking issues is more of an admission of poverty than progress. A second case does resonate. DLT can bring resilience, as it eliminates single points of failure. A CIO friend of mine recently pointed out how key resilience is when you operate across Africa.

Internal gains don’t have to use Blockchain

So, my summary view of the use of Blockchain / DLT to gain internal efficiencies is that neither tech generally, nor Blockchain specifically, is the deciding factor; banks have plenty of untapped potential to become more efficient, however a lack of discretionary spending is going to limit what is realised.

Internal Efficiency

Which gets us to external efficiencies. On this front, no institution on its own can achieve anything. Whether we are talking about what happens before there is a trade, aka pre-trade, or after the trade is made, so called post-trade, everything is a function of collaboration and sharing. Blockchain, aka Distributed Ledger Technology, is aimed squarely at both; the basic notion is that having a shared ledger improves controls and eliminates various administrative steps.

The sense we have of the industry consensus is that there is a shared view that the use of DLT is indeed this massive enabler of simpler process. Here are some good reasons why it will be worthwhile to invest our time in building better infrastructure for tomorrow.

Looking at the external efficiency side of the coin, I see three major themes that confront us:

- Process weakness & complexity: I have my favourite signposts in this area.

- Regulatory imperative & FMI complexity

- Unrealised potential

Process weakness & complexity

First, the 2018 report Accenture that suggested an annual savings potential of USD 8 billion plus across the industry, see: Banking on Blockchain, a value analysis for investment banks.

Trade is a focus area for things Blockchain; generally, the processes in trade are awkward. A 2014 Maersk study on a shipment of avocadoes from Kenya to Holland found that 10 of the 34 days the end-to-end process were spent idly waiting for admin to happen, see: “Blockchain DLT in Trade”, p5. According to a new study from Cointelegraph Consulting and Swiss enterprise blockchain firm Insolar, blockchain technology can reduce supply chain-related costs for businesses between 0.4% and 0.8%, which translates to USD 450 billion of costs.

Identity is another area where the status quo process just cries out to be improved. The cost of paperwork is a tax that is a burden on all investors. A current experiment in the US points to what is possible: Credit unions pilot blockchain-based digital ID system. A portable ID, do the formalities once and only once.

Regulatory imperative & FMI complexity

As part of the work to secure our Series A funding round, we looked at what a 1% change in credit & counterpart risk (CCR) was worth to the then members of the USC Project. On average USD 300 million in risk weighted assets per bank. With the technology currently available, we could have shorter settlement cycles right now, but the business process would struggle to adapt. If we can change the process, we can shorten the settlement cycle to “Instant” and / or “Today” and realise some of those savings.

We know from work by Oliver Wyman on Intraday Liquidity, that big banks have an average of USD 100 billion in liquidity buffers, with GSIBs at some 237 billon. 10 to 30% of that is to support intraday, i.e. the complexity of fragmenting liquidity and relying on intermediaries. So, that is at least 100 million in costs which are pretty much fixed on Jan 1 every year; like house contents or car insurance.

Unrealised potential

A core function of financial services is to efficiently move and allocate money and risk within an economy. Of course, the sector misfires. That said, we must look at where that efficiency is not optimised.

A report from HSBC & the Sustainable Digital Finance Alliance highlighted the potential in the ESG / Greenbond space: it helps remind us of the why in the work we are doing to create tomorrow’s financial market infrastructure.

- The costs associated with the current financial market infrastructure are a barrier to the capital allocation process; there is a demand for sustainable investments, call it ESG or Green bonds.

- DLT offers the prospect of:

- Cheaper & faster, issuance and trading. Meaning capital will be raised that otherwise wouldn’t, investment activity can take place that otherwise wouldn’t

- Better, because with the IOT, Internet of Things, the activity financed by that issuance activity will be measurable in a transparent way

I am also very excited by the signs of collaboration and intent in the loan industry; Finastra’s Lendercomm project is a really exciting prospect; process improvement at least, with the prospect of making loans more tradable.

Creating an on-chain payment system

To realise their potential all three themes need a means of payment, on-chain. If that last element is missing, then the potential will be either unrealised or reduced. The means of payment needs three component parts:

- The facility to create and destroy the DLT-based representation of the means of payment

- The organisation to support a participant community that alone in the wholesale markets would be very large; KYC, on-going due diligence, daily operations. In a peer-to-peer market, which is the very essence of DLT, every legal entity has direct access.

- The commercial coordination of all the activities to establish the means of payment as a single pool of liquidity connected to multiple business applications.

CBDC: the answer or an answer?

There has been a lot of talk about CBDC lately. Major currencies & their central banks are unlikely to embark down this path for retail business. See for example: Swiss Federal Government on CBDC. There is more openness to the use of CBDC, or perhaps sCBDC, a term coined by the IMF (see: IMF, The Rise of Digital Money). The IMF has also published some very clear notes on the thinking around CBDC: Central Bank Digital Currencies: 4 Questions and Answers.

Central banks could accomplish the first part listed above. The other two are not in their current DNA; could be done but require very careful long-term planning. There is clearly room for a public private collaboration.

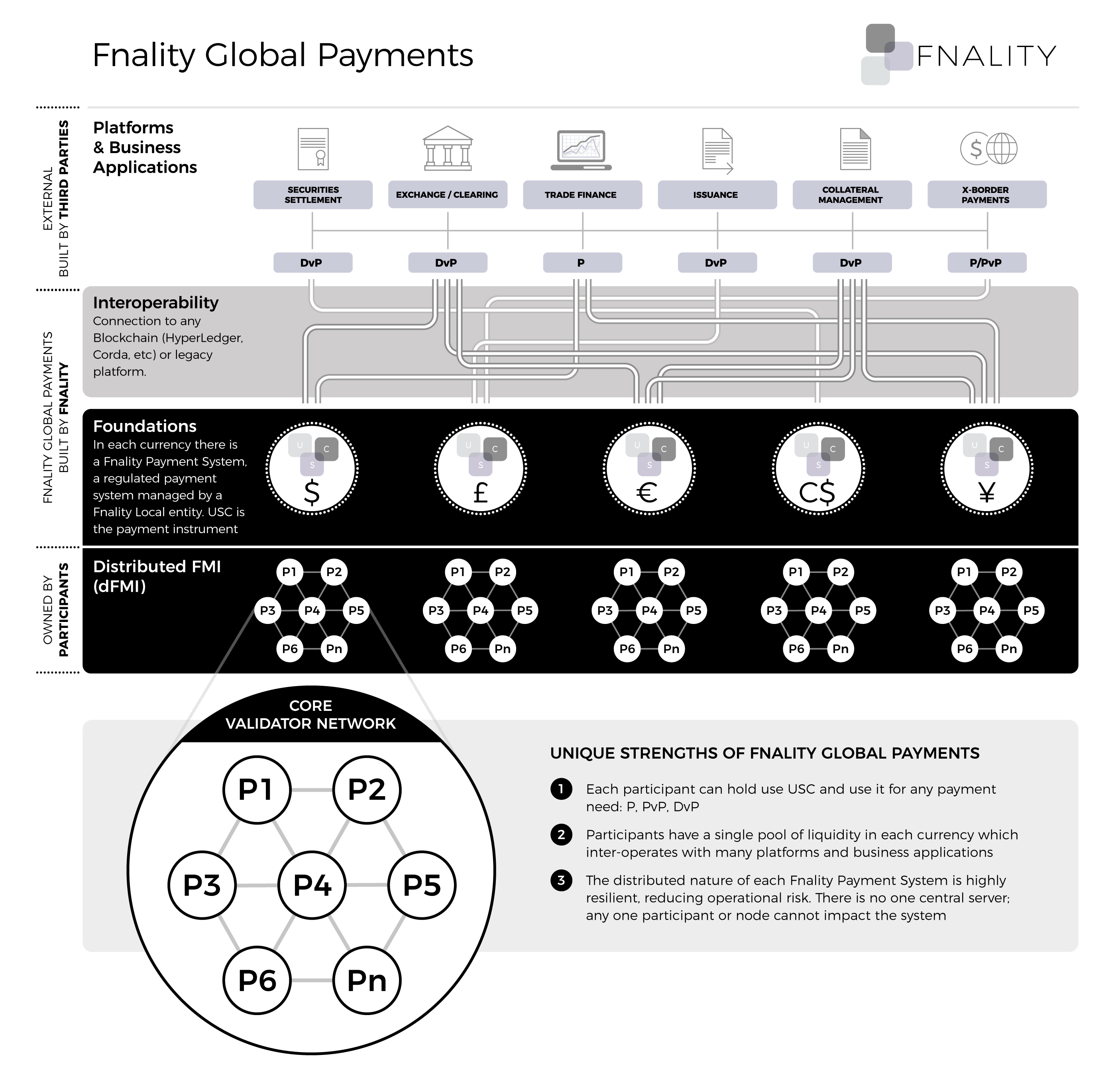

Figure 1: Fnality Global Payments

What Fnality is up to

At Fnality International, we understand that need for collaboration. We are focused on enabling the on-chain means of payment. In each currency we will have a Fnality Local which will run a payment system, the Fnality Payment System. USC is the payment instrument. The combination of all the Fnality Payment Systems will be called Fnality Global Payments. It will enable peer-to-peer markets by inter-operating with many platforms and business applications. Figure 1 illustrates how the components fit together.

One single pool of liquidity that can serve the settlement needs of many business platforms. Together with the work to tokenise collateral being led by HQLAx and Deutsche Boerse, this will allow us to realise something that has been the Holy Grail of our industry for many years; a single global collateral pool. This is worth understanding: Managing Payment Liquidity in Globak Markets: Risk Issues and Solutions Report by the Cross-border Collateral Pool Task Force.

Peer through the hype to the hope

“If revolution there is to be, let us rather undertake it than undergo it,” said Otto von Bismarck. In The digital money revolution, UBS’s Huw van Steenis offers a very clear view on why sitting undecided on the sidelines is a bad option and what the ingredients for success look like.

Or, more recently, as another German, Juergen Klopp, the ever-smiling manager of Liverpool Football Club, put it: “We must turn from doubters to believers”.

Believers in the sense that there is so much potential to unlock. Blockchain has made us examine and understand that potential; it will be a very good solution for many of our challenges, though not all of them. We need to focus on the hope, understanding that there will be some hype and that we should not let that distract us from trying to build the financial market infrastructure for the next 50 years.

If that has some “Blockchain inside”, that may well be no bad thing.